The prosperity survey report of the third quarter of 2022 - the prosperity of the security industry has rebounded significantly from the previous quarter

- Categories:Industry News

- Author:

- Origin:

- Time of issue:2022-10-24

- Views:0

The prosperity survey report of the third quarter of 2022 - the prosperity of the security industry has rebounded significantly from the previous quarter

(Summary description)In the first half of 2022, affected by the complex evolution of the international environment, the impact of domestic epidemic and other unexpected factors, the downward pressure on the economy was significantly increased. In the first half of the year, China's economy grew by 2.5% year-on-year, and in the second quarter, China's economy grew by 0.4% year-on-year, down 4.4 percentage points from the growth rate in the first quarter. Since June, with the epidemic gradually under effective control, the effect of macroeconomic support policies gradually emerging, and the orderly resumption of work and production, industrial production, investment, consumption and other fields have improved significantly on a month-on-month basis. The effect of economic recovery in August is relatively ideal, and the growth rate of major indicators has rebounded.

- Categories:Industry News

- Author:

- Origin:

- Time of issue:2022-10-24

- Views:0

In the first half of 2022, affected by the complex evolution of the international environment, the impact of domestic epidemic and other unexpected factors, the downward pressure on the economy was significantly increased. In the first half of the year, China's economy grew by 2.5% year-on-year, and in the second quarter, China's economy grew by 0.4% year-on-year, down 4.4 percentage points from the growth rate in the first quarter. Since June, with the epidemic gradually under effective control, the effect of macroeconomic support policies gradually emerging, and the orderly resumption of work and production, industrial production, investment, consumption and other fields have improved significantly on a month-on-month basis. The effect of economic recovery in August is relatively ideal, and the growth rate of major indicators has rebounded.

According to the data released by the National Bureau of Statistics, the added value of industries above designated size nationwide increased by 4.2% year-on-year in August, 0.4 percentage points faster than that of the previous month; The total retail sales of consumer goods increased by 5.4% year-on-year, 2.7 percentage points faster than last month; Fixed assets investment increased 0.36% month on month; The total import and export of goods increased by 8.6% year-on-year; The purchasing manager index of manufacturing industry was 49.4%, up 0.4 percentage points from the previous month; The non-manufacturing business activity index was 52.6%, 1.2 percentage points lower than the previous month, still higher than the critical point, reflecting the overall continued recovery of enterprise production and operation activities, but the expansion has weakened, and the recovery foundation still needs to be consolidated.

From the perspective of the development situation of China's security industry, the first and second quarters, especially the second quarter, were under great operating pressure. The main prosperity index declined significantly compared with the same period last year, and the situation gradually recovered in the third quarter. According to the industry prosperity survey data, the major prosperity indexes of the industry production scale, domestic market, enterprise profit, foreign trade export, fixed investment, scientific and technological innovation, and enterprise comprehensive business conditions in the third quarter have improved, and the entrepreneur confidence index has rebounded, but some problems in the industry development, including demand contraction, financing difficulties of small and medium-sized enterprises, need to be carefully analyzed and solved.

1、 Industry prosperity has improved

(1) The industry prosperity index rebounded and was in the "relatively prosperous range"

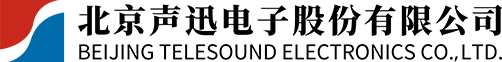

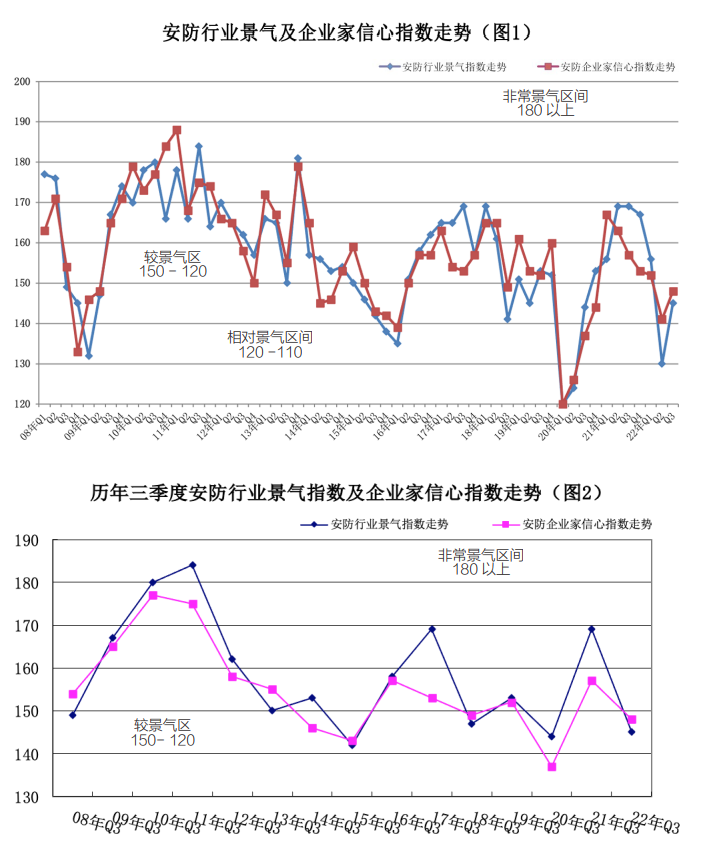

In the third quarter of 2022, the prosperity index of China's security industry was 142, up 12 points from the previous quarter and down 27 points from the same period last year, which is in the "relatively prosperous range" (see Figure 1-2). Among the surveyed enterprises, 60% of them believed that the operation was in a "good" state, up 17 percentage points from the previous quarter and down 16 percentage points from the same period last year; 25% of enterprises thought that "average or flat", 19 percentage points lower than the previous quarter and 8 percentage points higher than the same period last year; 15% of enterprises reported that their operations were in a "poor" condition, up 2 percentage points from the previous quarter and 8 percentage points from the same period last year.

(2) Production boom recovery

In the third quarter of 2022, the production (construction) prosperity index of the security industry was 138, up 16 points from the previous quarter and down 17 points from the same period last year, which is in the "relatively prosperous range" (see Figure 3). Among the respondents, 53% of the enterprises reported that the production (construction) scale was expanded compared with the previous quarter, and 33% of the enterprises reported that it was the same as the previous quarter; 15% of enterprises reported a reduction in production (construction) scale.

From the perspective of labor demand, the prosperity index in the third quarter was 121, which was the same as that in the previous quarter, and decreased by 23 points compared with the same period last year, which was in the "relatively prosperous range". Among them, enterprises reflecting the "increase" in labor demand accounted for 38%, up 1 percentage point from the previous quarter; The proportion of enterprises reflecting "flat" accounted for 45%, up 2 percentage points from the previous quarter; The "decrease" accounted for 17%, down 1 percentage point from the previous quarter.

(3) The domestic market is booming

In the third quarter of this year, the prosperity index of security products (engineering sales) was 135, up 17 points from the previous quarter and down 17 points from the same period last year, which is in the "relatively prosperous range" (see Figure 4-5). Among them, 50% of the surveyed enterprises had a new increase in sales, up 8 percentage points from the previous quarter; 35% of enterprises reported that sales were "flat", up 1 percentage point from the previous quarter; Fifteen percent of enterprises reported a "decline", up 9 percentage points from the previous quarter.

(4) Foreign trade exports are in the "micro boom zone"

In the third quarter of 2022, the prosperity index of foreign trade exports was 105, up 5 points from the previous quarter, and down 5 points from the same period of last year, which was in the "micro boom zone" (see Figure 6). Among them, 26% of the surveyed enterprises saw a new increase in foreign orders, down 6 percentage points from the previous quarter; 53% of enterprises reported that their sales were "flat", up 17 percentage points from the previous quarter; 21% of enterprises reported a "decline", down 11 percentage points from the previous quarter.

(5) Enterprise profit boom rebounded to "relatively prosperous range"

Production (engineering) cost slightly increased

In the third quarter of 2022, compared with the previous quarter, 45% of the surveyed enterprises reported that the production (engineering) cost was "rising", 55% reported that the production (engineering) cost was "flat", and no enterprises reported "falling". The proportion of "rising", "flat" and "falling" in the last quarter was 41%, 39% and 20% respectively.

Sales price fluctuates slightly

In the third quarter, 75% of the surveyed enterprises reported that the sales price of their products was "flat", 13% reported "rising" and 12% reported "falling". In the last quarter, the proportion of enterprises reporting "flat", "rising" and "falling" was 63%, 15% and 22% respectively.

Enterprise profit boom is in the "boom zone"

The profit prosperity index of security enterprises in the third quarter was 132, which was in the "relatively prosperous range" (see Figure 7), up 17 points from the previous quarter and down 10 points from the same period last year. Among the respondents, 50% of enterprises reported "increase (or decrease)", down 2 percentage points from the same period last year; 32% of enterprises reported "flat", down 6 percentage points from the same period last year; 18% of the enterprises reported "profit reduction (or loss increase)", up 8 percentage points from the same period last year.

(6) Increase the enthusiasm of enterprises

Investment in fixed assets is in the "relatively prosperous range"

In the third quarter of this year, the prosperity index of fixed asset investment of security enterprises was 126, up 5 points from the previous quarter, and located in the "relatively prosperous range" (see Figure 8). Among the surveyed enterprises, 33% of them continued to expand their investment in fixed assets, down 6 percentage points from the previous quarter; 60% of enterprises' investment remained unchanged, up 17 percentage points from the previous quarter; The investment of 7% of enterprises decreased, 11 percentage points lower than that of the previous quarter.

The investment in scientific and technological innovation of enterprises is in a "relatively prosperous range"

In the third quarter of 2022, the prosperity index of science and technology investment of security enterprises was 147, up 6 points from the previous quarter and down 14 points from the same period last year, which is in the "relatively prosperous range" (see Figure 9). Among them, 52% of enterprises continued to increase their investment in scientific research and development, 43% of enterprises' investment in scientific research was the same as that of the previous quarter, and 5% of enterprises' investment fell.

(7) The enterprise's capital situation and financing situation are relatively tight

Working capital. Enterprises with sufficient funds accounted for 35%, up 2 percentage points from the previous quarter; Enterprises that can maintain normal turnover accounted for 40%, up 10 percentage points from the previous quarter; The proportion of those who reflected the shortage of funds accounted for 25%, down 12 percentage points from the previous quarter.

Corporate financing. 21% of enterprises reported that financing was "easy", down 12 percentage points from the previous quarter; 48% of enterprises reported "average", down 1 percentage point from the previous quarter; 31% of enterprises reported "difficulties", up 13 percentage points from the previous quarter.

In terms of fund arrears. The number of enterprises reflecting the "increase in arrears" of funds was 27%, down 1 percentage point from the previous quarter; 61% of enterprises reported "flat", which was the same as the previous quarter; The number of enterprises reflecting "decrease" was 12%, up 1 percentage point from the previous quarter

2、 Entrepreneurs' confidence in future development has increased

In the third quarter, the confidence index of security entrepreneurs was 148, up 7 points from the previous quarter, and located in the "relatively prosperous range" (see Figure 1). Among the enterprises surveyed, 60% of the entrepreneurs hold an "optimistic" attitude towards the development of the industry, 28% of the enterprises think "average", and 12% think "not optimistic".

3、 Analysis and prediction of security market prospect in the fourth quarter

Adhering to the principle of stability and seeking progress while maintaining stability is the policy guidance for doing a good job of economic work this year. Although the current external situation is still complex and severe, and the domestic economic recovery still faces many difficulties and challenges, the fundamentals of China's long-term economic development and the factors and conditions supporting high-quality development have not changed. Looking forward to the second half of the year, most economists and professional institutions believe that with the implementation of a package of stable growth policies such as fiscal, monetary and industrial chain supply chain, the economy is expected to give full play to its advantages of resilience, potential and wide space, and achieve a quarterly recovery in growth.

From the perspective of the security industry, the challenges brought by the macro economic environment to the development of the industry and the operation of enterprises are objective, but the overall opportunities outweigh the challenges by integrating various factors such as industry policy support, domestic demand release, and technology upgrading. From the perspective of the survey enterprises, most of the survey enterprises are still optimistic about the development of the industry in the fourth quarter, and believe that the industry will accelerate its recovery in the next quarter with the overall improvement of the epidemic prevention and control situation, the release of policy effectiveness, and the effective promotion of the project. According to the survey of enterprises, about 53% of enterprises will increase their sales in the next quarter, and about 37% of enterprises will be the same as in the second quarter. It is expected that the development rate of the security industry will reach 6% in the next quarter, among which the video surveillance market will increase by more than 5%, the anti-theft alarm and physical protection will increase by about 4%, the access control will increase by more than 5%, the security of community residents will increase by more than 6%, and the growth rate of foreign markets is expected to be 4%.

From the perspective of foreign trade, the current overseas environment is still complex, but most of the overseas regions have gradually recovered from the epidemic, the economy has slowly recovered and grown, and the international security market has both opportunities and challenges. According to some survey enterprises, the export in the third quarter was steadily improving, and it is expected to continue to maintain the growth trend in the fourth quarter. From a regional perspective, the Asia-Pacific, Latin America, the Middle East and other regions currently have large growth space, and the United States, Britain, Australia and other countries and regions are greatly affected by political activities and political atmosphere. In the long run, the overseas market is still an important growth point, and Chinese enterprises will maintain strong product competitiveness overseas for a long time. Facing the international market, enterprises should properly adjust their overseas business strategies according to different market conditions.

From the perspective of the domestic industry market, in the field of construction and buildings, the survey enterprises reported that since this year, real estate projects have stopped in a large area, the demand has dropped sharply, the number of new product procurement projects has decreased, the payment collection is difficult and even bad debts have occurred, which has a great impact on the operation and survival of relevant enterprises. For the government market, due to the persistence and repetition of the epidemic in the past two years, many local governments have focused on the prevention and control of the epidemic, and the project progress has been slow. According to the survey enterprises, affected by the epidemic situation, some local governments have tight financial expenditure, and the investment in security projects is expected to be reduced. The investment in traditional network security and scientific and technological informatization will be reduced. The local budgets are limited, and nearly 50% of the projects will stop bidding. However, some enterprises also said that under the policy of developing digital government in recent years, local governments have invested more in digital reform. On the whole, with the stabilization of epidemic prevention and control work and the gradual implementation of policies related to stabilizing the economy, the business of some governments (people's livelihood) and the public security industry is gradually showing signs of improvement under the guidance of digital society and digital governance policies. For example, engineering projects in the field of data security and data fusion and sharing will gradually start bidding, and the number of information and innovation projects will continue to increase. There will still be good room for the medium and long-term growth of government projects.

Division of prosperity

Very prosperous range: above 180/strong prosperous range: 180-150/relatively prosperous range: 150-120/relatively prosperous range: 120-110/slightly prosperous range: 110-100 Weak depressed range: 100-90/relatively depressed range: 90-80/relatively depressed range: 80-50/relatively depressed range: 50-20/severely depressed range: below 20

The article is from China Security Products Industry Association

Scan the QR code to read on your phone